Prospective GB News Board Member is Fossil Fuel Investor

Original article by Adam Barnett and Sam Bright republished from DeSmog.

Lord Agnew is a shareholder in Equinor, the Norwegian oil and gas firm behind the ‘carbon bomb’ Rosebank oil field.

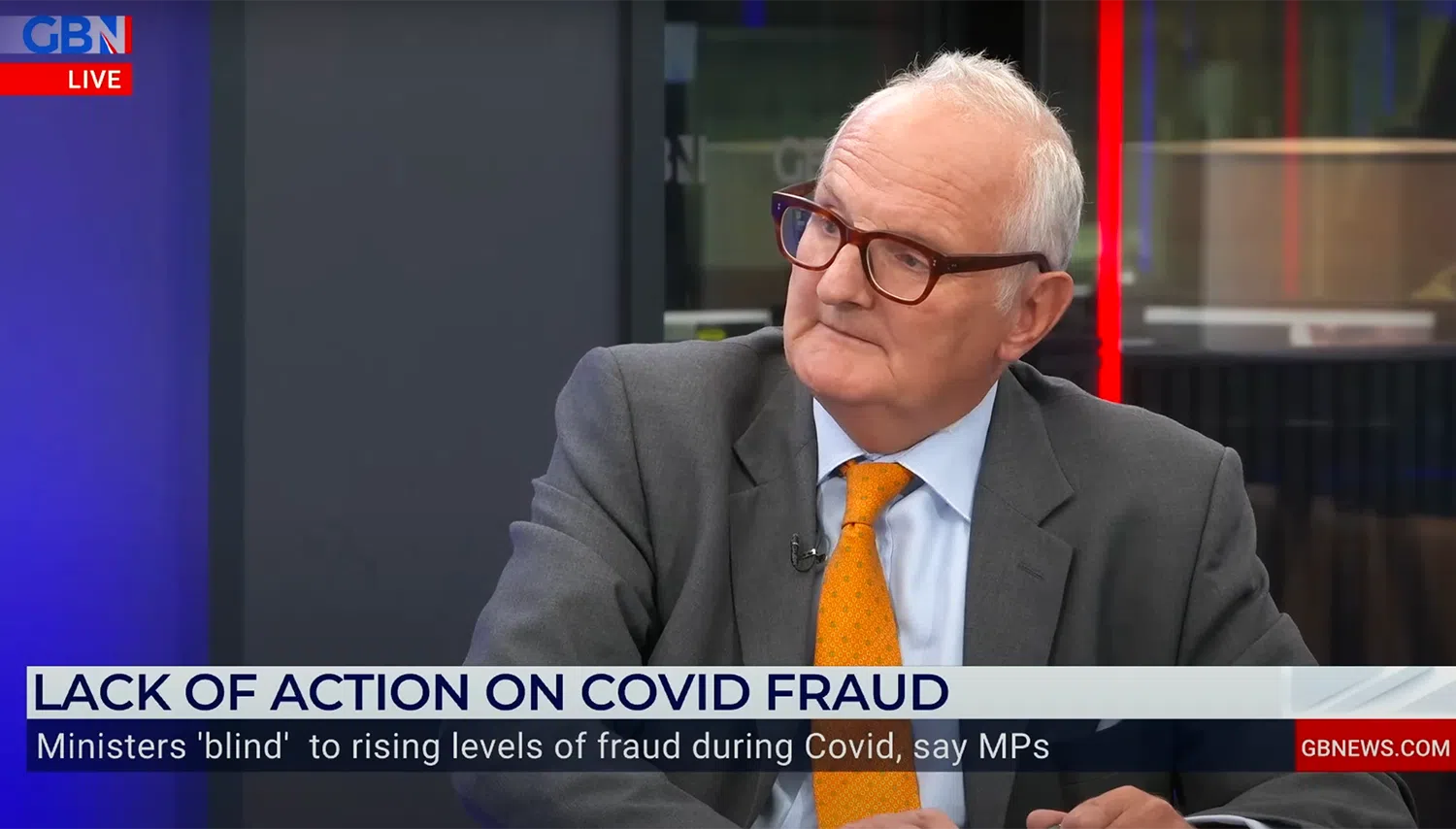

A Conservative peer who is expected to join the board of broadcaster GB News has shares in Equinor, the oil and gas multinational behind the Rosebank oil field in the North Sea.

According to his parliamentary register of interests, Lord Theodore Agnew has shares of at least £100,000 in Equinor, the Norwegian state-owned energy producer. Equinor has a majority stake in the Rosebank North Sea oil field, which has been dubbed a “carbon bomb” by environmental law charity ClientEarth.

Agnew is set to replace hedge fund millionaire Paul Marshall on the board of GB News’s parent company All Perspectives Ltd, according to Sky News.

Marshall is one of the key backers of GB News, holding a 45 percent stake in the company. He is reportedly planning to step back from GB News in order to launch a bid for the Telegraph Media Group, which includes The Telegraph newspaper and The Spectator magazine.

His withdrawal could potentially throw GB News into turmoil. The startup broadcaster has lost £76 million since its launch in 2021 and relies on the resources of Marshall and its other big stakeholder, UAE-based investment firm Legatum, to survive. Sky News reported that GB News is now preparing to make job cuts as part of a “corporate reorganisation”.

This may have implications for how climate change is covered in the UK. An investigation by DeSmog found that one in three GB News presenters had spread climate science denial on air in 2022, while more than half had attacked climate action.

“It comes as no surprise that members of the GB News board have ties to the oil and gas industry, given the way its presenters have championed continued oil and gas expansion,” said Tessa Khan, director of environmental non-profit Uplift.

Agnew, a former Cabinet Office minister under Boris Johnson, was in October appointed chair of UnHerd Ventures, another Marshall media vehicle. The company runs UnHerd, a publication founded in 2017 to give a platform to marginalised views.

Agnew also has shares in Carbon Plus Capital, a private investment company which specialises in carbon offsetting “based on the protection of forests”. This involves companies paying to plant trees to “offset” their greenhouse gas emissions.

Carbon offsetting is a controversial idea that has been criticised by climate campaigners as a form of greenwashing. An investigation published last year by newspapers The Guardian, Die Zeit and non-profit SourceMaterial found that 90 percent of rainforest carbon offsets approved by the world’s largest certifier Verra were “largely worthless” and could actually increase global heating.

Carbon Plus Capital partner Robin Warwick Edwards is a trustee of the Institute of Economic Affairs (IEA) think tank and the chair of its advisory council. The IEA, a free market group that has advocated for more fossil fuel extraction, received funding from BP for at least 50 years.

Agnew and Edwards declined to comment. GB News did not respond.

“Climate denial and investment in the fossil fuel industry go hand in hand”, said Carys Boughton of campaign group Fossil Free Parliament.

“It makes complete sense that an expected new board member of GB News – a channel absolutely committed to attacking climate science and policy at every turn – is invested in Equinor, a company that, according to research by Oil Change International, ranks eighth worst in the world for its commitment to expanding oil and gas production.”

She added: “By spreading disinformation about the climate crisis, GB News is feeding into the fossil fuel industry’s licence to operate and thus helping to line the pockets of the industry’s shareholders.”

GB News in Turmoil

GB News hosts regularly attack climate policies and the science behind them.

Numerous GB News presenters have also been vocal about their support for policies that would maintain and even extend the UK’s reliance on oil and gas.

On 9 December 2022, host Mark Dolan praised West Cumbria Mining’s plan to open a new coal mine in Cumbria. He said the UK should “drill, baby, drill” for coal, oil and gas, adding: “I think the push for net zero here is another element of liberal progressivism which is infecting the West.”

DeSmog revealed in October that Marshall Wace, the hedge fund run by Paul Marshall, had £1.8 billion invested in fossil fuel companies as of June 2023. This included Chevron, Shell, Equinor, and 109 other fossil fuel companies.

Marshall reportedly invested £10 million in GB News when it first launched two years ago and, in August 2022, joined the Dubai-based investment firm Legatum Group in a £60 million capital injection and buyout of GB News’s other major investor, Discovery.

If he joins the All Perspectives board, Agnew would become the latest Conservative politician to be adopted by the right-wing broadcaster. GB News hosts include Jacob Rees-Mogg, who was business and energy secretary under Liz Truss, Lee Anderson, a former Tory deputy chair who defected to anti-net zero party Reform UK last month, as well as Conservative MPs Esther McVey and Philip Davies.

The All Perspectives board also includes Tory peer Baroness Helena Morrissey and George Farmer, a Reform UK donor and the son of Conservative peer Lord Michael Farmer.

GB News reported losses of £42 million in the year to May 2023, and £76 million since its launch in 2021. This comes as rival populist channel TalkTV is closing its TV operation and switching to YouTube, having suffered losses of £90 million since it launched in 2022.

Agnew’s appointment has not been confirmed by Marshall, Agnew or the company.

“With advertisers steering clear, GB News is haemorrhaging cash – yet they continue to push misleading messages on climate change,” said Richard Wilson, director of the Stop Funding Heat campaign.

“In the last month alone, GB News commentators have claimed climate change is a ‘social mania’, dismissed climate harms as ‘hypothetical’, and attacked United Nations warnings about the need for urgent climate action as ‘hysteria’.

“Now we learn that a prospective GB News board member has fossil fuel investments”.

He added: “Britain urgently needs a media that supports the public interest – not the interests of a toxic industry that is putting all of our futures at risk”.

Fossil Fuel Projects

Equinor claims it supplies 27 percent of the UK’s energy from oil and gas, and is currently investing $6 billion (£4.8 billion) a year in fossil fuel exploration and drilling. It also says that it powers one million homes in Europe via renewable offshore wind.

Rosebank is the UK’s largest undeveloped oil and gas field, and could produce around 300 million barrels of oil over its lifetime, emitting 200 million tonnes of carbon dioxide.

In October, DeSmog revealed that Equinor urged the UK government to help promote the oil and gas industry, and was one of several companies which lobbied to water down the windfall tax on oil and gas company profits following Russia’s invasion of Ukraine.

The UK government controversially approved the Rosebank project in September, despite the International Energy Agency stating that new oil and gas exploration is incompatible with the ambition to reach net zero emissions by 2050. Green Party MP Caroline Lucas labelled the decision “morally obscene”.

Prime Minister Rishi Sunak used his address at the COP28 climate summit in December to claim that “climate politics is close to breaking point”, while stating that the UK will meet its net zero targets, “but we’ll do it in a more pragmatic way, which doesn’t burden working people”.

However, a 2023 court case found that the government’s plans only added up to 95 percent of the reductions needed to meet its net zero targets. The Conservative government has said it plans to “max out” the UK’s North Sea oil and gas reserves.

Tessa Khan added: “Those pushing for new oil and gas drilling, whether that’s the UK government, GB News or Equinor, are making things worse for the millions struggling with high energy bills and for those now struggling to cope with the impacts of climate change such as UK farmers – and all just to make a few oil and gas companies and their shareholders even richer.”

DeSmog has previously revealed that the Conservative Party received £3.5 million in donations from fossil fuel interests and climate science deniers in 2022, while two-thirds of the directors in charge of the party’s multi-million-pound endowment fund have a financial interest in oil, gas, and highly polluting industries.

Original article by Adam Barnett and Sam Bright republished from DeSmog.