Eurobond tax scandal: David Cameron accused of dodging concerns over loophole that costs Treasury at least £500m a year

Prime Minister refuses to explain why he hasn’t stopped use of Eurobond exemption

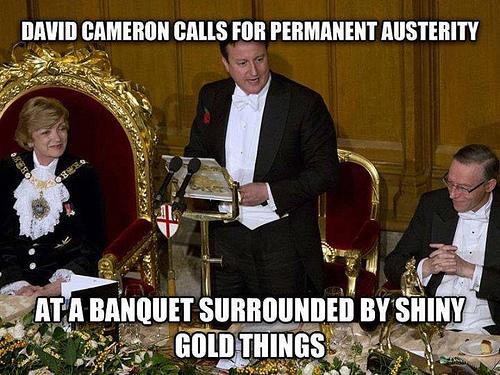

David Cameron’s attempts to “brush aside” legitimate concerns that the Government has not yet closed a legal tax loophole, which is losing the public purse at least £500m a year, have been condemned by MPs and campaigners.

David Cameron’s attempts to “brush aside” legitimate concerns that the Government has not yet closed a legal tax loophole, which is losing the public purse at least £500m a year, have been condemned by MPs and campaigners.

When asked at Prime Minister’s Questions about revelations in The Independent that the Coalition had failed to stop the use of the quoted Eurobond exemption to avoid tax, Mr Cameron said decisions had been made by the Treasury and implied that was the end of it.

Shabana Mahmood, Labour MP for Birmingham Ladywood and shadow Exchequer Secretary to the Treasury, said: “It’s pretty shocking that David Cameron just brushed aside this important question. We’re talking about a loophole that costs us around half a billion a year, yet the Prime Minister arrogantly dismisses the issue. At a time when families are facing a cost-of-living crisis and the deficit is high, this isn’t good enough.”

She added: “David Cameron and George Osborne must explain why they decided not to close this loophole. And we need a government that takes tax avoidance seriously and is on the side of the majority of families and businesses who pay their fair share.”

The campaign group UK Uncut says it is now considering targeting the high-street chains highlighted in The Independent, which include Nando’s, Pizza Express, Café Rouge, BHS, Maplin, Office and Pets at Home. The companies all cut their taxable profits by borrowing at high interest from their owners through the Channel Islands Stock Exchange.

…

27/11/13 Having received a takedown notice from the Independent newspaper for a different posting, I have reviewed this article which links to an article at the Independent’s website in order to attempt to ensure conformance with copyright laws.

I consider this posting to comply with copyright laws since

a. Only a small portion of the original article has been quoted satisfying the fair use criteria, and / or

b. This posting satisfies the requirements of a derivative work.

Please be assured that this blog is a non-commercial blog (weblog) which does not feature advertising and has not ever produced any income.

dizzy

Tax Special Investigation: How Camelot has avoided millions in tax – with help from teachers in Canada

The great Eurobond tax scandal

Camelot, the company behind the National Lottery, has avoided millions of pounds in corporation tax by exploiting a legal loophole that HMRC failed to close.

The company saved an estimated £10m in tax in the last two years through interest on loans taken from its Canadian owner via the Channel Islands Stock Exchange. Its owner is one of Canada’s largest pension plans, the Ontario Teachers’ Pension Plan board. The revelation comes as the National Lottery has doubled the price of its tickets to £2.

…

The Government estimated in 2012 that the loophole was costing the public purse some £200m, but publicly available accounts suggest the true cost could be more than £500m – and probably higher.

…

27/11/13 Having received a takedown notice from the Independent newspaper for a different posting, I have reviewed this article which links to an article at the Independent’s website in order to attempt to ensure conformance with copyright laws.

I consider this posting to comply with copyright laws since

a. Only a small portion of the original article has been quoted satisfying the fair use criteria, and / or

b. This posting satisfies the requirements of a derivative work.

Please be assured that this blog is a non-commercial blog (weblog) which does not feature advertising and has not ever produced any income.

dizzy

Tax Special Investigation: HMRC ‘particularly feeble’ over failure to close loophole

Despite the tax exemption costing the UK economy at least £500m a year, the Government bowed to pressure after intense lobbying from the financial sector to allow companies to use it

The Government chose not to close a tax loophole which costs the UK economy at least £500m a year after intense lobbying from the financial sector, The Independent has learnt.

<snipped>

More than 30 companies are paying more than £2bn in total to their overseas owners every year as interest on borrowings. As these can be deducted from the companies’ taxable UK income, this amounts to a corporation tax saving of around £500m when compared to equivalent investment in shares in the company.

Without the exemption, any tax savings from the interest deductions would be greatly reduced by the 20 per cent withholding tax that HMRC would otherwise take from interest payments going overseas. As many more companies list debt in the Channel Islands, and the loophole also works in other exchanges including Luxembourg and the Cayman Islands, the total tax lost may be significantly higher.

…

27/11/13 Having received a takedown notice from the Independent newspaper for a different posting, I have reviewed this article which links to an article at the Independent’s website in order to attempt to ensure conformance with copyright laws.

I consider this posting to comply with copyright laws since

a. Only a small portion of the original article has been quoted satisfying the fair use criteria, and / or

b. This posting satisfies the requirements of a derivative work.

Please be assured that this blog is a non-commercial blog (weblog) which does not feature advertising and has not ever produced any income.

dizzy

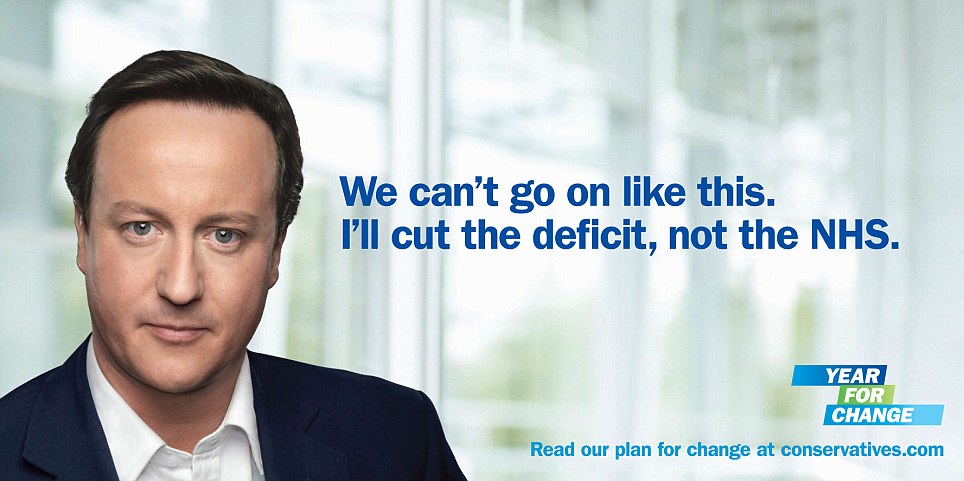

NHS news review & other news

- Conservative election poster 2010

A few recent news articles about the UK’s Conservative and Liberal-Democrat (Conservative) coalition government – the ConDem’s – brutal attack on the National Health Service.

Hundreds of GPs issue a rebuttal to a letter that appeared on Monday by an unrepresentative group of doctors claiming that the British Medical Association is not representative of GPs’ views on ConDem plans to destroy the NHS.

Doctors rebut claim most favour health reforms – Telegraph

Opening it up to “competing private providers” will lead to “fragmentation, chaos and damage to the quality and availability of patient care”, according to 365 GPs, specialists and health academics.

The letter is a tit-for-tat move in response to one from 56 in favour, published in Saturday’s edition.

It was written and signed by senior GPs who are leading the set up of clinical commissioning groups (CCGs), which will be handed the lion’s share of the NHS budget when primary care trusts are abolished.

They had warned that the Bill’s failure would put the health service “in peril”, arguing: “The risks of derailing the development of clinical commissioning cannot be underestimated.”

But today’s letter, signed by more than six times as many doctors, throws that language back at them.

“The NHS is not in peril if these reforms don’t go ahead,” they write. “On the contrary, it is the Bill which threatens to derail and fragment the NHS into a collection of competing private providers.”

They argue the Bill “will result in hundreds of different organisations pulling against each other leading to fragmentation, chaos and damage to the quality and availability of patient care”.

BBC News – Government offers NHS bill concessions

The government is to promise the health secretary will keep ultimate control over the NHS in England, as it pushes for Parliament to pass its NHS bill.

The legislation, which would bring a fundamental reorganisation of the service, has encountered opposition from peers and various groups.

But ministers will later table amendments aimed at quelling unrest.

These will include giving more powers to the health watchdog and doing more to encourage medical research.

Through the Health and Social Care Bill, Health Secretary Andrew Lansley is proposing the biggest shake-up since the NHS was founded in 1948.

‘Backdoor privatisation’

Under the plans, groups of GPs will take charge of much of the NHS budget from managers working for primary care trusts, while more competition with the private sector will be encouraged.

The British Medical Association, the Royal College of Nurses and the Royal College of Midwives have all opposed the proposals, with some critics claiming they are unworkable and amount to “backdoor privatisation”.

…

BBC News – Private firm starts running NHS Hinchingbrooke Hospital

A private firm has become the first to start running an NHS hospital.

Circle, which is co-owned by doctors, has taken on managing Hinchingbrooke Hospital, Cambridgeshire, which had been threatened with closure as it grappled with £40m of debt.

Circle aims to find a solution to the debt problems of the hospital by attracting new patients.

Union Unison said although the hospital had been saved, it was concerned at involving private firms in the NHS.

…

Lansley pledges a million more people will have access to an NHS dentist | Mail Online

NHS dentists are to treat an extra million patients following a shake-up in funding.

Health Secretary Andrew Lansley will today pledge that everyone who lost their NHS dentist since 2006 will now have access to one.

The Coalition has set aside £28million, trimmed from the NHS budget via efficiency savings, to pay for the new patients.

The funding will be given to primary care trusts, who have bid for the cash by setting out proposals to expand local services.

They will fund new dentists, increase the number of appointments with existing ones, or provide care in people’s homes for patients who cannot travel to a surgery. Between 2006 and 2008, a million Britons lost access to an NHS dentist.

…

In other news:

There’s a difference between a veto and an abstention or voluntary exclusion. The difference is that a veto prevents something from happening. David Cameron has a different interpretation of a veto.

Any suggestions for an improved name for this beer? Unloved, Discarded Mutt Ale? Muttley Ale? What a howler? Barking Mad?

Why that veto looks less like a victory | Mail Online

Less than two months ago David Cameron said ‘no’ to Europe. He vetoed a treaty agreed by every other EU member state to impose tighter fiscal disciplines across Europe.

As a result of his veto, Britain rejoiced. Just in time for Christmas, the Prime Minister won his best ever press coverage. His ratings soared. Finally we had someone in Downing Street who wasn’t afraid to upset other EU leaders.

The moment seemed exciting, even historic. Many on both sides of the great European debate – sceptics and enthusiasts – concluded that Britain was now in the EU’s departure lounge and it was only a matter of time before Britain formed a very different relationship with Brussels.

But today Cameron’s Christmas veto looks much less significant than it did. After he used it, he repeatedly promised to stop the countries which had signed that new treaty from using European institutions such as the European Court of Justice – which are part funded by British taxpayers – to implement and police it.

This week it became clear that he was not going to fulfil that promise. His resounding ‘no’ has become a tepid ‘oh, go on then’. Little wonder that Ed Miliband taunted the Prime Minister yesterday, saying the veto turned out to be just for Christmas, not for life.

…

Wheelchair users block Oxford Circus to protest at disability cuts | Society | The Observer

‘We’re not scroungers and fakers’ say wheelchair protesters

Disability activists blocked one of central London’s busiest road junctions on Saturday with a line of wheelchair users chained together in the first of a series of promised direct action protests against government welfare cuts.

The demonstration, which brought much of Oxford Circus to a standstill for more than two hours, was the product of an alliance between disabled groups and UK Uncut, which came to prominence by staging similar direct actions against corporations accused of avoiding tax.

Planned cuts to the disability living allowance could see 500,000 disabled people losing money, the charity Mencap has said.

Many of those taking part said they had never before joined a demonstration, let alone taken such direct action, but felt angry at the proposed cuts and the associated rhetoric from ministers and the media.

“The tabloids have created this idea that we’re scroungers, or fakers,” said Steven Sumpter, 33, who left his home in Evesham, Worcestershire, at 6.30am. “This has allowed the government to do this [propose the cuts]. Disabled people are seen as a good scapegoat.”

BBC News – Ministers seek to overturn peers’ welfare bill changes

The government will seek to overturn seven defeats inflicted by the House of Lords to its Welfare Reform Bill later.

Ministers will urge the Commons to reject peers’ amendments to the bill, including those to disability allowances proposed on Tuesday.

They will also rule out Labour calls to scrap a £26,000 benefits cap in favour of variable limits for different localities, calling them “unworkable”.

Labour says the government needs to create jobs before cutting benefits.

Far-reaching changes to welfare entitlements are needed, ministers argue, to help people out of dependency on the state, increase incentives for work and make the benefits system fair to both claimants and taxpayers.

But campaigners say the proposals – which ministers also hope will save billions – risk pushing already vulnerable people into further hardship and distress.

…

A reputation shredded: Sir Fred loses his knighthood | Business | The Guardian

Ex-RBS chief executive pays price for role in the recession, leading to calls for others to be stripped of honours

The former chief executive of the Royal Bank of Scotland, Fred Goodwin, has been stripped of his knighthood by the Queen for his role in the creation of the biggest recession since the second world war.

With unceremonial haste, a committee of five senior civil servants took away the knighthood given to Goodwin by the last Labour government in 2004 for services to banking.

The chancellor, George Osborne, welcoming the move, said: “RBS came to symbolise everything that went wrong in the British economy over the past decade.”

…

Which is a handy distraction for the ConDems from this story whereby they were previously claiming that they could not intervene in obscene bonuses for bankers.

Labour vows to maintain pressure on RBS bonuses | Business | The Guardian

Ed Miliband says Stephen Hester bonus row cannot be a one-off as party pledges to look at payments to other senior bank staff

Labour has said it will put further pressure on RBS executives to rein in excessive bonuses after helping to force the bank’s chief executive, Stephen Hester, to abandon his plan to take a £1m share bonus.

The shadow business secretary, Chuka Umunna, described RBS employees as public sector workers and said Labour would be taking a close look at the bonuses offered to the bank’s senior staff.

The threat of a Commons vote to condemn the size of Hester’s bonus was pivotal in persuading him to forgo his bonus, even though it had been sanctioned by the board and had the implicit endorsement of David Cameron.

The Labour leader, Ed Miliband – looking for victories to strengthen his leadership – can reasonably claim that his party effectively led the charge demanding Hester’s rethink, but now faces the challenge of setting out the wider criteria by which he will judge other salaries and bonuses in the City.

…

Apple criticism grows as ‘accidental activists’ make their point | Technology | guardian.co.uk

Almost 150,000 people sign online petition which calls for tech giant to clean up its act on alleged human rights abuses in China

Mark Shields, a communications worker in Washington DC, did not intend to become an activist calling for Apple to clean up its act over allegations of brutal labour abuses in its Chinese supplier network.

But, listening to a recent radio show on the subject, Shields, a dedicated user and fan of Apple products, felt he had to act. He was going to write a letter to Apple until a friend suggested he start a petition at change.org, an online group that facilitates campaigning on controversial subjects.

In its first 48 hours, Shield’s petition attracted more than 140,000 signatures. Now more 147,000 people from all around the world have signed up, and it has become one of the main focuses of consumer discontent at the way Apple makes its sleek computer products that have become a mainstay of much of modern life. “I am an accidental activist here. I have never started a petition before,” Shields, 35, told the Guardian. “I am an Apple person, I have my MacBook and iPhone. I love all that stuff. These products have changed my life, but they are coming at a cost in human suffering,” he added.

…

Soon to be whistleblower who worked for Monsanto will be releasing documents detailing how Monsanto planned to kill off bee colonies in order to introduce a “new and improved” species of bee that will only pollinate Monsanto crops

Relevant: Monsanto buys company researching death of bees:

http://www.businessweek.com/ap/financialnews/D9Q1M0UO0.htm

And for those who said crops aren’t pollinated by bees? You’re wrong. Alfalfa is http://blog.targethealth.com/?p=58

And if you think Monsanto isn’t dominating our government? Read some cables released by wikileaks all about our officials asking for

talking points from them, our ambassadords urging trade wars on their behalf:

Are they evil enough to do this? Read up about Monsanto:

http://www.vanityfair.com/politics/features/2008/05/monsanto200805?currentPage=1

posted by Armando Rozário ¹²³ macanese – Cabo Frio, Brazil – January 30, 2012.

- 1

- 2

- 3

- 4

- …

- 6

- Go to the next page