‘Huge’: 1,600+ Institutions Holding $41 Trillion in Assets Have Now Divested From Fossil Fuels

Original article by OLIVIA ROSANE at Common Dreams shared under Creative Commons (CC BY-NC-ND 3.0).

The milestone, one campaigner said, should “give hope to folks that we are making an impact.”

An earlier version of this story said that 16,000 institutions had divested. The correct number is 1,600 and it has been updated to reflect that.

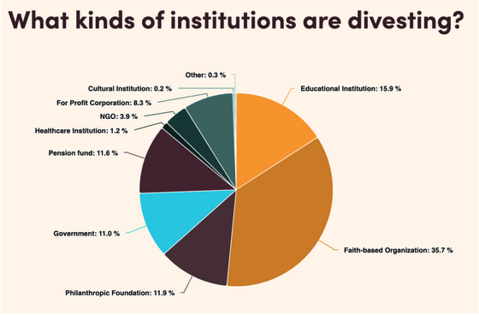

More than 1,600 institutions like universities, pension funds, and governments that hold more than $40.6 trillion in assets have now divested from fossil fuels, the Global Fossil Fuel Divestment Movement announced Friday.

The announcement comes days after the 28th United Nations Climate Change Conference wrapped with a call for “transitioning away from fossil fuels” but stopped short of agreeing to the stronger “phaseout” of oil, gas, and coal backed by climate advocates and frontline communities.

“This number is huge,” Amy Gray, Stand.earth climate finance associate director and coordinator of the Climate Safe Pensions Network, told Common Dreams. To put it in perspective, $40.6 trillion is equal to a little less than half of global gross domestic product.

The scale of the divestments to date, said Gray, “should show and give hope to folks that we are making an impact and we are making a difference and changing things for the better, regardless of these elitist events where the everyday person and the folks in the Global South and other places are discounted.”

A Decade of Divestment

Friday’s update to the Global Fossil Fuel Divestment Commitments Database reflects around a decade of organizing, Gray said. Organizers at 350.org started tracking divestment commitments when Gray and current Stand.earth climate finance director Richard Brooks worked there. When the pair moved to launch a climate finance team at Stand.earth, they brought the database with them.

While the divestment movement has seen ups and downs over that decade, Gray said it had picked up momentum over the last five or six years. In less than two years, the number of institutions divesting jumped by 120, holding a combined $1.4 trillion in assets.

“We’ve definitely seen a massive increase in divestment commitments as the divestment movement has built itself out and gotten stronger,” Gray said.

“This milestone follows years of attempted shareholder engagement, now a proven futile strategy, with fossil fuel corporations hell-bent on our destruction.”

Notable victories in 2023 included PMT, the largest private pension in the Netherlands; New York University, the National Academy of Medicine, and the Church of England.

The Church of England divestment was especially notable, Gray said, because of the statement that accompanied it. The church emphasized that it had tried to engage with the oil and gas companies it was invested in and urged them to adopt policies in line with the Paris agreement, but the companies did not change.

“The decision to disinvest was not taken lightly,” Alan Smith, first church estates commissioner, said at the time. “Soberingly, the energy majors have not listened to significant voices in the societies and markets they serve and are not moving quickly enough on the transition. If any of these energy companies come into alignment with our criteria in the future, we would reconsider our position. Indeed, that is something we would hope for.”

Gray remembered thinking at the time that it was the best divestment statement she’d ever read.

“It was really powerful,” she said.

The Church of England wasn’t the only institution that thought it could persuade Big Oil to change its ways without divesting.

“This milestone follows years of attempted shareholder engagement, now a proven futile strategy, with fossil fuel corporations hell-bent on our destruction,” Brooks said in a statement. “Instead of financing climate chaos-causing fossil fuels, violence, and extraction, financial institutions like big banks and pension funds must protect people and planet alike, cutting ties with fossil fuels and reinvesting in proven community-led climate-safe solutions.”

People vs. Fossil Fuels

The success of the divestment movement has been driven by “people power, 100%,” Gray said.

This includes larger organizations like Stand.earth or the Sierra Club and big-name activists like Bill McKibben or former New York Comptroller Tom Sanzillo, but ultimately comes down to smaller grassroots efforts.

“It’s the little group in Wisconsin that’s working on divesting their pension fund,” Gray said. “It’s a small group in the Bay Area who is pressuring Citi or one of the big banks, and it’s the kids at the colleges.”

“Oil companies are finding it increasingly difficult to raise financing amid rising ESG and sustainability concerns.”

There’s evidence that all this activism is making a difference for the industry. The “cost of capital” for funding new fossil fuel projects has risen steeply in the last decade, from 8% to 10% to around 20% as of 2021, according to Bloomberg.

During the same time, the cost for financing renewables has dropped from that same 8% to 10% to between 3% and 5%.

Bloomberg Intelligence analyst Will Hares laid the divergence at the feet of the push for environmental and social governance (ESG) in investing.

“Oil companies are finding it increasingly difficult to raise financing amid rising ESG and sustainability concerns, while banks are under pressure from their own investors to reduce or eliminate fossil-fuel financing,” Hares said.

Gray also added that Indigenous-led movements such as the Wet’suwet’en struggle against the Coastal GasLink pipeline in Canada have had a material impact on the industry.

The pipeline’s costs have more than doubled during that time from an estimated $6.6 billion to $14.5 billion, CBC News reported this month.

At the same time, divesting from fossil fuels is actually a financial win for pension funds and other institutions: A study released this year by the University of Waterloo found that six U.S. pension funds would actually be $21 billion richer today if they had quit fossil fuels 10 years ago.

The Next 1,600

In the context of a disappointing outcome at COP28, President Joe Biden’s greenlighting of drilling projects, and the specter of a second Trump presidency, the success of the divestment movement offers hope that climate campaigners can shift the world away from fossil fuels without needing to rely on international agreements or national legislation.

“It’s not necessary to enact the change we need to see,” Gray said. “We can change these systems of oppression from within.”

Looking ahead to 2024, Gray thinks there’s a good chance that California will finally pass legislation to divest its two pension funds, CalPERS and CalSTRS, from fossil fuels. The two funds, the largest public pensions in the country, control a total of $685 billion, including more than $42 billion in fossil fuels.

“Even the person with the smallest amount of investments can get involved.”

If California does pass the legislation, it will “cause a massive ripple effect,” Gray said.

“If we’re able to divest the two largest pension funds in the country, there’s nothing we can’t divest.”

Another thing Gray expects to see is more coordination between the efforts to divest from both fossil fuels and the weapons industry, as more and more people react with shock watching U.S.-made and -funded arms devastating the people of Gaza.

“War is a climate issue,” Gray said.

For people not yet involved in the divestment movement, Gray recommends signing up for email updates from Stand.earth or the Climate Safe Pensions Network and looking up local climate groups and going to a meeting.

“Even the person with the smallest amount of investments can get involved,” Gray said. “Anybody can join the climate movement, and we’re always ready to help folks take that step.”

Original article by OLIVIA ROSANE at Common Dreams shared under Creative Commons (CC BY-NC-ND 3.0).

- A Divestment Movement Milestone Proves People Power Gets the Goods

- 11 Reasons To Divest From The Fossil Fuel Industry ›‘The Tide Has Shifted’: Harvard To Divest From Fossil Fuels After A Decade Of Pressure ›

- ‘A Huge Win For Climate Justice’: NYU To Divest From Fossil Fuels ›

- US Public Pensions Are Paying Huge Price For Not Divesting From Fossil Fuels, Report Shows ›

- ‘Something Big Is Shifting’: As Georgetown Announces Fossil Fuel Divestment, Students Across US Demand Their Schools Follow Suit ›

- ‘Investing In Humanity’: British Medical Journal Praised For New Fossil Fuel Divestment Campaign ›