Morning Star: We need an emergency Budget – but there’s no relief in sight

BRITAIN needed an emergency Budget today, one that addressed the profound crises facing local authorities, healthcare, education, you name it.

It got nothing of the sort. A scattering of headline investments like the “NHS productivity plan,” focused on IT systems and ignoring the staff shortages that have led to waiting lists seven million long.

A 2p cut to National Insurance that benefits higher earners more and, by reducing the tax take, tightens the funding squeeze on essential services. Bigger cuts to capital gains tax, incentivising the property speculation that has helped drive the housing crisis.

It was a complacent Budget, Chancellor Jeremy Hunt spending longer trying to explain away Britain’s “technical” recession as some kind of economic success (the same Chancellor said last year he was “comfortable” with Bank of England policy causing a recession to reduce wages) than he did outlining new measures that might make a difference.

Britain has “turned the corner” on inflation, he claims, though prices rising more slowly doesn’t mean prices falling and millions of us know what we pay for food, energy and a roof over our heads has soared in recent years.

…

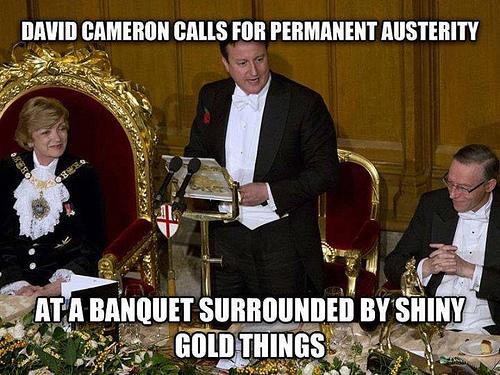

There is plenty of money. Last month Britain’s Big Four banks announced their highest annual profits ever.

We see record-breaking profits in the energy cartels, big agribusiness, soaring profit margins in the FTSE 350 table of big companies. These aren’t “difficult economic circumstances.” It is class war.

And if Labour won’t strike a blow for workers in that war, unions will need to find another way to change our country’s direction.

Rich scum are used to people sucking up to them. There’s no need to do that of course – they’re only rich scum. Class War was probably the best at not sucking up to the rich.

Rich scum are used to people sucking up to them. There’s no need to do that of course – they’re only rich scum. Class War was probably the best at not sucking up to the rich. One thing about rich scum is that they consume hugely so making massive contributions to climate change. Private jets, superyachts, expensive cars, frequent flying, owning and maintaing large residences or private islands.

One thing about rich scum is that they consume hugely so making massive contributions to climate change. Private jets, superyachts, expensive cars, frequent flying, owning and maintaing large residences or private islands.