Emissions of Richest 1% Will Cause 1.3 Million Heat Deaths: Oxfam

Original article by JAKE JOHNSON republished from Common Dreams under Creative Commons (CC BY-NC-ND 3.0).

“The super-rich are plundering and polluting the planet to the point of destruction and it is those who can least afford it who are paying the highest price.”

The richest 1% of the global population produced 16% of the world’s carbon dioxide in 2019, generating as much planet-warming pollution as the poorest two-thirds of humanity, according to a report released Monday by Oxfam International.

Climate Equality: A Planet for the 99% describes the fossil fuel-driven climate emergency and runaway inequality as “twin crises” that are leaving those least responsible for planetary breakdown to bear the worst consequences, from catastrophic extreme weather to food and water shortages.

“If no action is taken, the richest will continue to burn through the carbon we have left to use while keeping the global temperature below the safe limit of 1.5°C, destroying any chance of ending poverty and ensuring equality,” the report warns. “The world needs an equal transformation. Only a radical reduction in inequality, transformative climate action and fundamentally shifting our economic goals as a society can save our planet while ensuring wellbeing for all.”

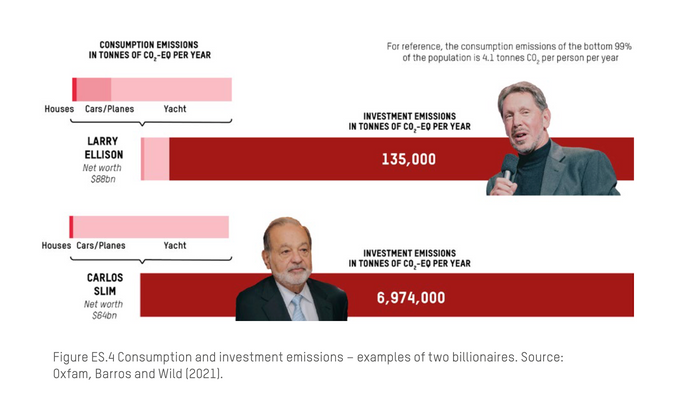

Using the latest available emissions data from the Stockholm Environment Institute, Oxfam calculated that it would take roughly 1,500 years for a person in the bottom 99% to produce as much CO2 pollution as the world’s top billionaires create in a year. The annual emissions of the global super-rich cancel out the emissions-reduction impact of nearly a million onshore wind turbines, according to the report.

The report also estimates that the emissions of the top 1% in 2019 will cause 1.3 million heat-related excess deaths in the coming decades, with most of the deaths occurring in the current decade.

Oxfam noted that transportation is far and away the largest source of pollution from the ultra-rich, whose private jets, yachts, and fleets of gas-guzzling cars are highly carbon-intensive. Experts at Indiana University estimated in 2021 that a “superyacht” emits more than 7,000 tons of CO2 per year.

Climate activists have also increasingly targeted private jet travel as a key source of luxury emissions. Oxfam observed in its new report that “a short trip on a private jet will produce more carbon than the average person emits all year.”

The report comes in the wake of news from the World Meteorological Organization that global greenhouse gas concentrations reached an all-time high once again last year, underscoring the need for dramatic action to curb fossil fuel use and transition to renewable energy.

Chiara Liguori, Oxfam’s senior climate justice policy adviser, said in a statement that “the super-rich are plundering and polluting the planet to the point of destruction and it is those who can least afford it who are paying the highest price.”

“The huge scale of climate inequality revealed in the report highlights how the two crises are inextricably linked—fueling one another—and the urgent need to ensure the rising costs of climate change fall on those most responsible and able to pay,” said Liguori.

“Governments globally, including the U.K., need to tackle the twin crises of inequality and climate change by targeting the excessive emissions of the super-rich by taxing them more,” Liguori added. “This would raise much-needed revenue that could be directed to a range of vital social spending needs, including a fair switch to clean, renewable energy as well as fulfilling our international commitments to support communities who are already bearing the brunt of the climate crisis.”

Oxfam’s report calls on governments to pursue a “radical increase in equality” by imposing wealth taxes on the richest 1% as well as steep inheritance, land, and property taxes. The report also recommends taxing or banning private jet travel, space tourism, and other polluting luxury activities and imposing “permanent, automatic” windfall profit levies on major corporations that often take advantage of crises such as wars and pandemics.

Additionally, Oxfam urged governments to invest heavily in establishing universal programs—from healthcare to education to childcare—and transitioning away from fossil fuels. The group said that rich countries must honor their commitments to provide climate financing to poor nations facing the brunt of the climate crisis and support debt cancellation and other relief measures.

“Unless we rapidly reduce carbon emissions,” the report states, “we will exhaust the amount of carbon we can emit without triggering climate breakdown within just five years.”

Original article by JAKE JOHNSON republished from Common Dreams under Creative Commons (CC BY-NC-ND 3.0).

dizzy: We’ve had a 5 years warning before and not from David Bowie.