It is confirmed that NHS Croydon is £35 million in debt.

GMB members at Western Hospital, Swindon complain of harassment by hospital contractor Carillion and intend to ballot for strike action.

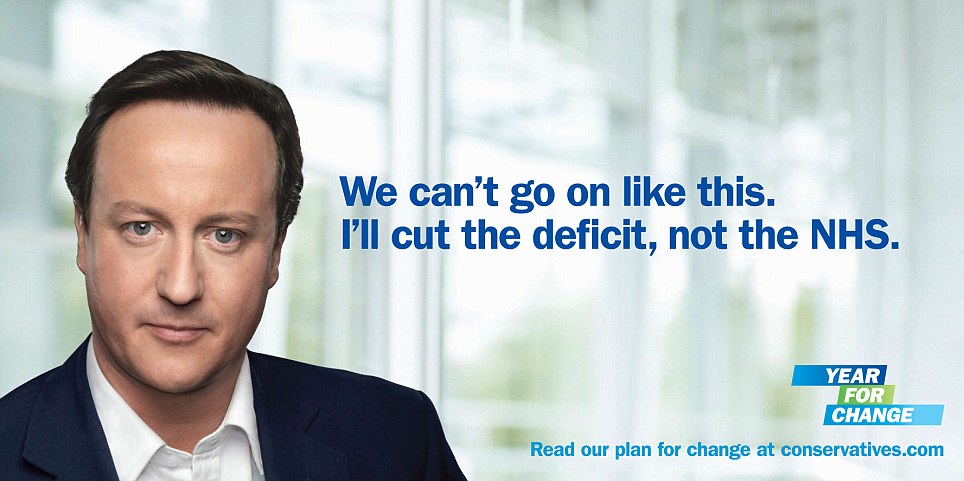

- Conservative election poster 2010

A few recent news articles about the UK’s Conservative and Liberal-Democrat (Conservative) coalition government – the ConDem’s – brutal attack on the National Health Service.

NHS Croydon has announced it has overspent by as much as £35 million this financial year.

The primary care trust (PCT) blamed “higher activity in hospitals” and “understated budget setting” as the main causes of its “significant budgetary challenge”.

…

NHS Croydon told the Advertiser this evening that the overspend for 2011/12 had been reduced to around £23 million “following the release of financial reserves”.

A spokeswoman said: “As a result of the ongoing detailed analysis of all Croydon PCT budget lines over the last few months we have identified a significant budgetary challenge for Croydon 2011/12.

“We believe we are spending between £30m and £35m more on healthcare than we have in our budget which equates to six per cent of our annual spend on the population of Croydon.

“We are taking robust action to resolve this problem. We are developing a detailed action plan to get back into balance and ensure robust financial planning for the future to live within the funding we are given each year from central government.”

…

Carole Vallelly GMB Regional officer said “GMB members at the hospital had a private meeting with Paul Kenny GMB General Secretary when he visited them at hospital today (Monday 12 December). He was told of the myriad problems members are experiencing at the hands of managers of Carillion. He was told that these problems have as their root the PFI contractor’s failure to deal properly with concerns over holiday arrangements, shift arrangements and general consultation with the staff. Instead they face a culture of bullying, harassment and discrimination.

They asked that their concerns be reported to the Central Executive Council (CEC) of the union so that they could be given authority to ballot for strike action to get the problems addressed. I will now take steps to consult members to ensure that there is a full report to next CEC asking for authority to move to an official strike ballot on this matter.”

Paul Kenny speaking after his meeting with members said “GMB is calling on Swindon and Marlborough NHS Trust to investigate these allegations of bullying, harassment and discrimination in the contract run in their name by Carillion.

There is no place in a modern health service for bullying, harassment or discrimination. Either the Trust takes action about this or the union members will”.

The wrong cure

How cuts will make Britain more unfair

The government says that its cuts programme is not just unavoidable, but also fair and progressive. Is this true?

You can argue about the meaning of fair, but progressive has a definition. If what the government is doing is progressive it would take from the rich and give to the poor (or at least hit them much less than the rich).

Independent experts say the cuts are not progressive.

Let’s first look at the changes in tax and benefits, and then at the impact of cuts in services.

Tax and benefits

Whether changes in tax and benefits are progressive is relatively easy to measure as these are flows of cash.

The Institute of Fiscal Studies is well respected as an independent analyst. It says that the government’s claim that the tax and benefit changes in the budget and spending review are progressive is wrong.

This graph is from their analysis of George Osborne’s first budget:

It shows the biggest losers are the poorest 10 per cent of families with children.

The IFS also had this to say about October’s spending review:

Our analysis (of the budget) shows that … the impact of all tax and benefit measures yet to come reduces the incomes of lower income households by more than that of higher income households, with the notable exception of the richest 2% of the population who are the hardest hit. Therefore the tax and benefit changes are regressive rather than progressive across most of the income distribution. And when we add in the new measures announced yesterday this finding is, unsurprisingly, reinforced. So our analysis continues to show that, with the notable exception of the richest 2%, the tax and benefit components of the fiscal consolidation are, overall, being implemented in a regressive way.

This is the IFS analysis of all government policies on tax and benefit by 2015. The poorest lose the most. It is only the impact of the previous government’s tax increases for the wealthy that make the top ten per cent bigger losers than some of those who are poorer.

Spending cuts

Working out the impact of the cuts in spending on services is harder. Some parts of public spending benefit all of us – such as many environmental protection measures.

But other parts of public spending do benefit some people more than others. To give a simple example the richer you are, the less likely that you use the bus.

Researchers for the TUC trawled official statistics to gather information about how different income groups benefit from public spending. With these figures, and by assuming that everyone benefits equally from spending like environmental protection and defence, they were able to work out whether the cuts were progressive.

This chart shows the value of the services lost as a proportion of household income.

Again the impact of the cuts is much harder on the poor and those in the middle than it is on the rich. The poorest ten per cent suffer 15 times more than the richest.

The impact on women

The Womens’ Budget Group is a group of independent experts who have been working with the Treasury to analyse the effect of economic policies on women.

This is what they said about the impact of the Spending Review:

- Lone parents and single pensioners – most of whom are women – will suffer the greatest reduction in their living standards to public service cuts. Lone parents will lose services worth 18.5% and female singles pensioners services worth 12% of their incomes.

- Overall single women will lose services worth 60% more than single men as proportions of their incomes, and nearly three times the amount lost by couples.

- The cuts will lead to hundreds of thousands of women losing their job. 53% of the jobs in the public sector services that have not been protected from the cuts are held by women. The pay and conditions of all public sectors workers, 65% of whom are women, are likely to deteriorate.

- Cuts in welfare spending fall disproportionately on women’s finances. Child benefit is paid almost 100% to women; while 53% of housing benefit claimants are single women. Both benefits have been cut significantly in real terms and eligibility has been tightened.