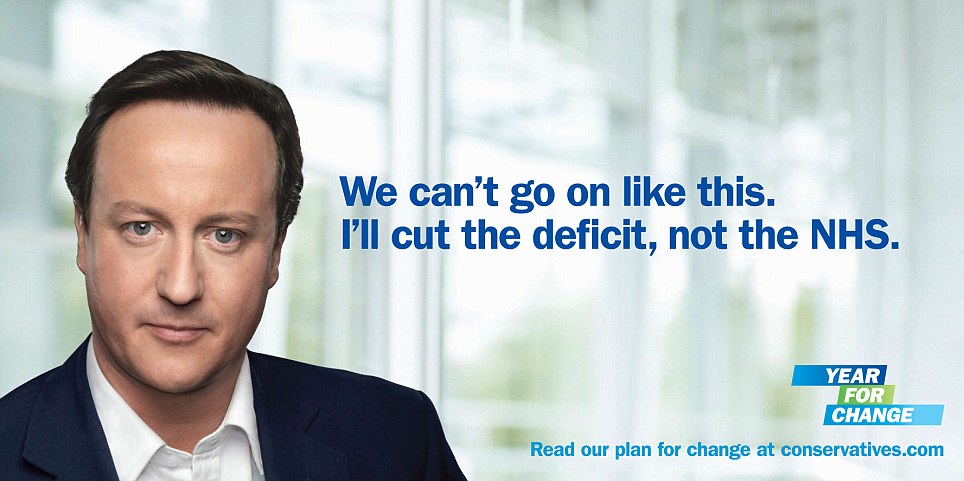

- Conservative election poster 2010

A few recent news articles about the UK’s Conservative and Liberal-Democrat (Conservative) coalition government – the ConDem’s – brutal attack on the National Health Service.

Do you realise that Cameron objected to EU attempts to impose a transaction tax on big finance? Unfairly protecting bankers yet again is what the spat between Inger-lander Cameron and the EU is about.

Shadow Health Secretary Andy Burnham claims that the health ‘reforms’ are an affront to democracy and that there is no mandate to change the NHS.

“With all eyes on Europe, a constitutional mess closer to home is going largely ignored. Last week, the Government’s Health and Social Care Bill, one of Whitheall’s longest-running farces, hit a new low. Coalition peers trooped obediently through the lobbies on Wednesday to defy the Information Commissioner. He had ruled that the Department of Health should publish its risk register to help to inform their Lordships’ consideration of the Bill and shed light on the risks of reorganising the NHS at this time of unprecedented financial pressure.

Instead, Tory and Lib Dem peers backed the Government’s fight to keep it secret, thereby denying the wider public the chance to learn about the risks its government is running with the NHS. Outrageous – but entirely in keeping with the way the coalition has handled this most important of Bills.”

…

[A total waste of time article saying nothing.]

Philip Green

Philip Greed is a multi-billionaire businessman, who runs some of the biggest names on British high streets. His retail empire includes brands such as Topshop, Topman, Dorothy Perkins, Burton, Miss Selfridge and British Home Stores.

Philip Green is not a non-dom. He lives in the UK. He works in the UK. He pays tax on his salary in the UK. All seems to be in order. Until you realise that Philip Green does not actually own any of the Arcadia group that he spends every day running. Instead, it is in the name of his wife who has not done a single day’s work for the company. Mrs Green lives in Monaco, where she pays not a penny of income tax.

In 2005 Philip Green awarded himself £1.2bn, the biggest paycheck in British corporate history. But this dividend payout was channeled through a network of offshore accounts, via tax havens in Jersey and eventually to Green’s wife’s Monaco bank account. The dodge saved Green, and cost the tax payer, close to £300m. This tax arrangement remains in place. Any time it takes his fancy, Green can pay himself huge sums of money without having to pay any tax.

Before the election, the Lib Dems liked to talk tough on tax avoiders. But as soon as they entered the coalition, this pre-election bluster became just another inconvenient promise they quietly forgot. In August David Cameron appointed the country’s most notorious serial-tax avoider to advise the government on how best to slash public spending. Not a single Lib Dem minister uttered a word of complaint. A Guardian editorial denounced this as “shameful”.

Philip Green’s £285m tax dodge could pay for:

- The full, hiked up £9,000 fees for almost 32,000 students

- Pay the salaries of 20,000 NHS nurses