There is an alternative: The case against cuts in public spending – PCS

…

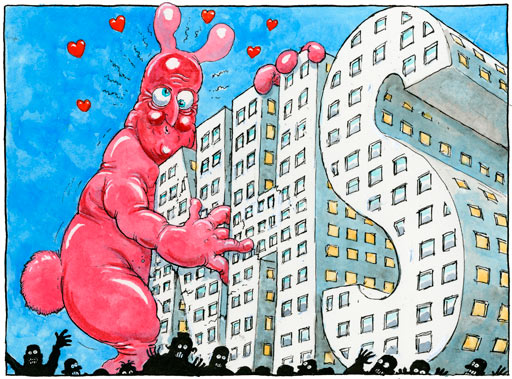

Tax justice

Addressing the ‘tax gap’ is a vital part of tackling the deficit. Figures produced for PCS by the Tax Justice Network show that £25 billion is lost annually in tax avoidance and a further £70 billion in tax evasion by large companies and wealthy individuals.

An additional £26 billion is going uncollected. Therefore PCS estimates the total annual tax gap at over £120 billion (more than three-quarters of the annual deficit!). It is not just PCS calculating this; leaked Treasury documents in 2006 estimated the tax gap at between £97 and £150 billion.

If we compare the PCS estimate of the tax gap with the DWP estimate of benefit fraud, we can see that benefit fraud is less than 1% of the total lost in the tax gap (see diagram opposite).

Employing more staff at HM Revenue & Customs would enable more tax to be collected, more investigations to take place and evasion reduced. Compliance officers in HMRC bring in over £658,000 in revenue per employee.

If the modest Robin Hood tax – a 0.05% tax on global financial transactions – was applied to UK financial institutions it would raise an estimated £20–30bn per year. This alone would reduce the annual deficit by between 12.5% and 20%.

Closing the tax gap, as part of overall economic strategy, would negate the need for devastating cuts – before even considering tax rises.

Our personal tax system is currently highly regressive. The poorest fifth of the population pay 39.9% of their income in tax, while the wealthiest fifth pays only 35.1%. We need tax justice in personal taxation – which would mean higher income tax rates for the richest and cutting regressive taxes like VAT and council tax.

Cut the real waste

While it is not necessary to cut a penny in public expenditure due to the ‘deficit crisis’, there are of course areas of public spending which could be redirected to meet social needs.

In the civil and public services, we know there are massive areas of waste – like the £1.8 billion the government spent on private sector consultants last year. The government could get better advice and ideas by engaging with its own staff and their trade unions.

There is also the waste of the government having 230 separate pay bargaining units, when we could have just one national pay bargaining structure.

There are also two other large areas where government costs could be cut.

Trident

The current Trident system costs the UK around £1.5 billion every year.

A private paper prepared for Nick Clegg (in 2009, when in opposition) estimated the total costs of Trident renewal amounting to between £94.7bn and £104.2bn over the lifetime of the system, estimated at 30 years. This equates to £3.3bn per year.

At the time Nick Clegg (now Deputy Prime Minister) said: “Given that we need to ask ourselves big questions about what our priorities are, we have arrived at the view that a like-forlike Trident replacement is not the right thing to do.”

The 2010 Liberal Democrat manifesto committed the Party to: “Saying no to the like-for-like replacement of the Trident nuclear weapons system, which could cost £100 billion.”

PCS policy is to oppose the renewal of Trident and invest the money saved in public services, whilst safeguarding Ministry of Defence staff jobs.

War in Afghanistan

The war in Afghanistan is currently costing £2.6 billion per year. The war is both unwinnable and is making the world less safe. More important than the financial cost are the countless Afghan and British lives that are being lost in this conflict.

The PCS alternative…

- There is no need for cuts to public services or further privatisations

- Creating jobs will boost the economy and cut the deficit. Cutting jobs will damage the economy and increase the deficit

- We should invest in areas such as housing, renewable energy and public transport

- The UK debt is lower than other major economies

- There is a £120 billion tax gap of evaded, avoided and uncollected tax

- The UK holds £850 billion in banking assets from the bailout – this is more than the national debt

- We could free up billions by not renewing Trident

- End the use of consultants

…