Clare Gerada discusses her opposition to the Health and Social Care / Destroy the NHS Bill.

Private company Circle to run a hospital for profit.

Tax boss most wined and dined mandarin – study | Business | The Guardian

HMRC head David Hartnett attended 107 events in three years, with accountancy firms among those extending largesse

Britain’s most senior official in charge of collecting tax was named yesterday as the most wined and dined mandarin in Whitehall. According to an investigation, David Hartnett, the permanent secretary for tax at HM Revenue and Customs, accepted invitations to eat and drink 107 times over the past three years.

Prominent among those extending corporate largesse were the top accountancy firms, which are paid by big business to find ways of avoiding paying tax.

Hartnett, 59, who lists his recreations as food and wine in Who’s Who, has been accused of being too cosy with large corporations. He emerged top of the league in an investigation by the Bureau of Investigative Journalism, a not-for-profit body based at City University London, which collated more than 3,000 instances of hospitality given to top civil servants in the past three years.

Hartnett sat down with representatives of the “big four” accountancy firms 27 times. He ate with KPMG 10 times and went to one reception. He also accepted hospitality from PricewaterhouseCoopers seven times, Ernst & Young four times and Deloitte three. Last September he clocked up four dinners, two lunches and two breakfasts paid for by, among others, unnamed private equity chief executives, PWC and KMPG. On 17 September he had breakfast courtesy of the now merged City firms JP Morgan and Cazenove, followed by lunch the same day with accountants from BDO Stoy Hayward.

Corporate hospitality is part of Hartnett’s approach to raising tax from big firms. Rather than confronting them, he has relied on persuading them to pay their share of tax.

…

Protesters demand resignation of HMRC boss for colluding with tax avoiders | Left Foot Forward

Protesters are descending on Whitehall today to demand the resignation of HM Revenue & Customs (HMRC) boss Dave Hartnett for his role in approving deals that allow big companies to avoid billions in tax.

Activists from UK Uncut and Occupy London are protesting Hartnett’s role in approving “secret sweetheart deals” to allow feral companies to dodge billions in tax – money that could have been used to fund public services going into the pockets of the irresponsible rich.

Hartnett was made to answer MPs’ questions over the scandal, which enabled Vodafone and Goldman Sachs to effectively rob the taxpayer of £6 billion and £10 million respectively. MPs on the public accounts committee have accused Hartnett of abusing his position to “cover up his own mistakes”.

A survey in 2010 revealed Hartnett to be Britain’s most ‘wined and dined’ civil servant, treated by corporations 107 times in three years. Commentators from across the political spectrum and even Conservative MPs have also called on Hartnett to resign.

As Occupy London’s Kyshia Davey says:

“HMRC has just announced it will be going after 146,000 pensioners to demand hundreds of pounds from them following a tax code cock-up. Meanwhile, its boss is striking secret deals with opulent corporations to let them off billions of pounds in tax.

“Hartnett is fatally undermining public confidence in the UK’s tax system at a time of austerity and he must resign immediately.”

And UK Uncut’s Sam Gilbert adds:

“Whilst 25,000 rank-and-file staff at HMRC have been fired, leaving the organisation almost incapable of functioning, Hartnett has been carving out a career as the most ‘wined and dined’ civil servant in Whitehall.

“The money from Vodafone’s £6bn tax dodge alone could have prevented all of the cuts in public services over the past year.”

All in it together?

MPs hit out at Vodafone ‘tax let-off’ – UK Politics – UK – The Independent

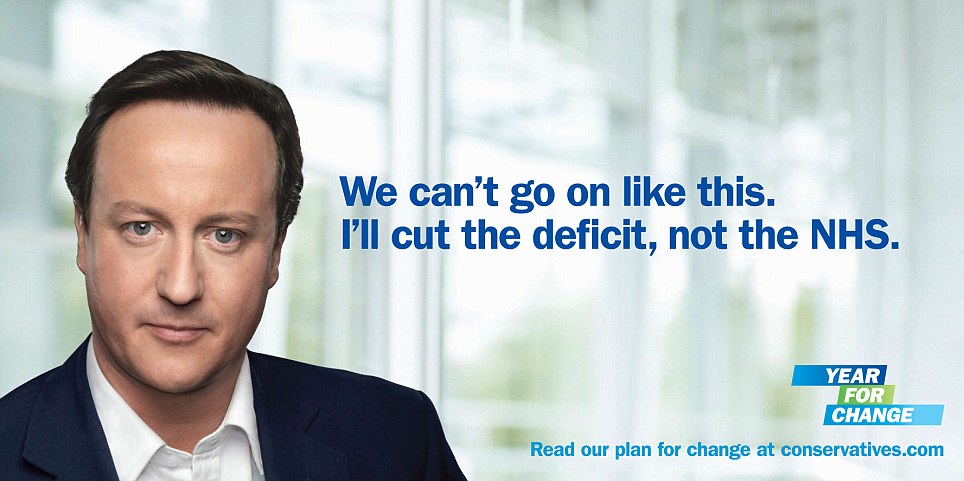

- Conservative election poster 2010

A few recent news articles about the UK’s Conservative and Liberal-Democrat (Conservative) coalition government – the ConDem’s – brutal attack on the National Health Service.

New Statesman – Royal College of GPs chair attacks NHS reforms

Royal College of GPs chair attacks NHS reforms

Clare Gerada tells the New Statesman: “This reform is so large you can see it from outer space”

In this week’s magazine, Clare Gerada, physician and chairman of the Royal College of General Practitioners, talks to the New Statesman’s Sophie Elmhirst about her fears for the future of the NHS, David Cameron’s betrayal, and the ways in which patients will suffer as a result of Health Secretary Andrew Lansley’s reforms:

We’ve got three big things going on at the same time – a massive reorganisation of the health service, alongside a serious financial situation, alongside the NHS having to make £20bn efficiency savings. So it is difficult to say which one is going to cause “X, Y, Z”, but certainly patients are going to experience longer waiting lists; they’ll see less choice available. Irrespective of whether the government says there is going to be more choice: there won’t be more choice.

In line with the General Practitioners’ Committee’s stance against the reform bill’s Quality Premium, Gerada is outspoken about performance-related bonuses for GPs:

In the [reform] bill, the government is suggesting that GPs be rewarded for keeping in budget. There is no problem in GPs having an incentive to practise good, evidence-based medicine. Where it becomes a step too far is where we are rewarded for keeping patients out of hospital. Because you have to trust me, you have to trust that I have stopped you from going to hospital because it is in your best interests, not because I am going to get £10, £15, £20 or whatever it is. And that begins to distort the doctor/patient relationship, which has to be fundamentally built upon trust — otherwise what’s the point of it?

Gerada speaks of being “absolutely surprised” by the reforms proposed by a coalition government she has had no discussions with:

Like others, I heard David Cameron say “no top-down reorganisation of the NHS”. I was so relieved, because I had lived through 15 reorganisations . . . [But this reform] isn’t so much putting GPs in charge of commissioning, but about dismantling the systems and the architecture of the NHS.

The NHS is our NHS. It is one of the last things that we as the people – the taxpayers – own, and by owning it our Health Secretary and our parliament is responsible for it. For £120 billion of taxpayers’ money, somebody has to be accountable to parliament. . . . It is symbolic if [Health Secretary Andrew Lansley] is no longer accountable for our national health service.

BBC News – Circle in deal to run Hinchingbrooke NHS hospital

A groundbreaking £1bn, 10-year deal for a private firm to run a struggling NHS hospital has been confirmed.

Circle, which is part-listed on the London Stock Exchange, is to take over Hinchingbrooke hospital in Huntingdon, Cambridgeshire, from 1 February 2012.

The deal will see Circle assume the financial risks of making the hospital more efficient and paying off its debts but the hospital will stay in the NHS.

The company must maintain services but unions fear staff numbers could be cut.

Although private sector firms already operate units that treat NHS patients – such as hip replacement centres – the firm will become the first non-state provider to manage a full range of NHS district general hospital services.

Hinchingbrooke hospital is one of about 20 hospitals in England which has faced an uncertain future, and the possibility of closure, because of long-term financial problems.

It is carrying about £40m of debt and its financial status has been given a high risk red rating by the NHS. The franchise deal with Circle was developed after concerns that the hospital had become unviable, and a local campaign to maintain services.

Circle describes itself as a social enterprise because 49.9% is owned by a partnership of employees. Others see it as a private business as the rest is owned by its parent company, Circle Holdings, which is listed on the stock market.

…

27/11/13 Having received a takedown notice from the Independent newspaper for a different posting, I have reviewed this article which links to an article at the Independent’s website in order to attempt to ensure conformance with copyright laws.

I consider this posting to comply with copyright laws since

a. Only a small portion of the original article has been quoted satisfying the fair use criteria, and / or

b. This posting satisfies the requirements of a derivative work.

Please be assured that this blog is a non-commercial blog (weblog) which does not feature advertising and has not ever produced any income.

dizzy