MPs concluded “the suspicion must remain that the Department of Health does not want the full story to be revealed.”

£10billion a year may be a conservative estimate

In fact the increase in administration costs due to the ‘market’ is likely to be even higher than £10bn.

Professor Colin Leys, author of ‘The Plot Against the NHS’, told OurNHS that these figures relate to 2003, before the second big wave of market ‘reforms’ including “the Independent Sector Treatment programme, the huge expansion of the Commercial Directorate of the Department of Health, the marketing division set up to help trusts learn to advertise and sell their services, the Competition and Cooperation panel, Monitor’s vast expansion…”

The key driver of high NHS inflation is rising drug and medical device costs, new, expensive clinical possibilities, and rising demand as the population ages, runs the accepted wisdom. So why have administration costs kept pace with – or even outstripped – these unavoidable inflationary drivers? Shouldn’t we expect to see administration costs forming a falling proportion of NHS costs?

Professor Webster told OurNHS that instead, “serial reorganisations and escalating marketisation are imposing enormous cost and waste on the NHS, with administrative costs spiralling out of control since 1980.”

Professor Leys adds, “It of course depends on how much you think admin costs would have risen anyway to deal with more complex interactions of modern health care, but to my mind attributing 20% of all NHS costs to admin costs [ie about £25billion], and half of that to the costs of operating as a market, is very reasonable.”

Professor Paton takes a more conservative view, halving the £10billion figure to conclude that “the recurrent annual costs of the market can be estimated (conservatively) at £4.5 billion”.

He concludes in his report earlier this year that the NHS market itself is “an unaffordable ideological luxury”, with few if any discernible benefits.

The market and ‘transaction costs’

Away from the academic estimates, though, a quick glimpse at the empty hospital carpark after the managers and admin staff have left for the day, brings home the reality of how much must be being spent on paperwork and IT white elephants to administer the market.

The market introduces ‘transaction costs’ – advertising, negotiating, contracting, invoicing, billing, auditing, monitoring contracts, collecting information, resolving disputes both in courts and out, all employing and training a ballooning bureaucracy – even leaving aside any profits extracted by the private sector.

At the grassroots, Hackney GP Jonathan Tomlinson told OurNHS that applying the ‘market’ adds huge costs at every stage, “because they diffuse through every interaction, from a decision to prescribe or perform a scan, make a referral, set up a service or close a hospital.”

Then there’s what Paton calls the “circular re-organisation”, with endless “re-invention of expensive agencies under different names supposedly abolished, alongside the costly complexity of the new, often overlapping, agencies …”

How many managers does it take to change a health system?

Each competing NHS ‘provider’ Hospital and Ambulance Trust has executive officers on 6 figure sums, with their Chief Executives often earning more than the Prime Minister. Most spend millions on hiring even higher-paid management consultants in year after year, too – though these figures aren’t centrally collected anywhere.

Then there’s the 211 Clinical commissioning Groups, advised by soon-to-be privatised Commissioning Support Units and NHS England (the biggest quango in history). All of them shove a lot of cash at the management consultants, too (under central quango instructions).

Then there’s the ballooning bureaucracy created to regulate and further marketise this decentralised jumble – the NHS Trust Development Authority, Monitor, the Care Quality Commission, NHS Professionals, NHS Property Services, Healthcare UK… Some of these bodies are soon to be privatised themselves – but, just like the rest of the ‘shadow state’ of management consultants and thinktanks, they’ll still be receiving huge chunks of public money.

Just one of those organisations – West and South Yorkshire and Bassetlaw Commissioning Support Unit – employed 36 public relations workers at a cost of more than £1.4million a year.

Of course the NHS needs managers – but this many? Duplicated across so many fragmented, competing, deficit-ridden organisations?

There have been recent tentative attempts to cost some of the individual elements of the market. Just the legal fees to comply with one Clause of the Health & Social Care Act cost local Clinical Commissioning Groups £77million a year, Labour uncovered earlier this year.

However the Opposition’s critique focuses mainly on the £1.5-£3billion cost of the latest re-organisation – allowing the government to claim that these are one-off costs they’ll recoup in the long run.

Not one-off costs

The ongoing costs of the current system, however, are huge.

It costs the ‘purchasers’ a fortune. The government is now putting the ‘commissioning support’ infrastructure itself out to tender. It is offering to pay private companies another £5bn – not even to provide healthcare, but just to provide yet more advice on how to run the NHS as a market.

And hospital cash is sucked up in fending off the private sector, too. Earlier this year, the competition to run just one hospital – George Eliot – cost at least one and a half million pounds of public money, my Freedom of Information requests revealed. Over half, £771,000, went straight into the pockets of the big 4 management consultancy firms. Such sums are not atypical – nor is the fact this process changed absolutely nothing, in the end.

Another million pounds has just been blown on tendering ‘older people’s services’ in the East of England – again for the private sector to try (and fail) to demonstrate they could do a better job. But the private sector has got deep pockets – and will keep trying.

There are tens of thousands more of these expensive tenders underway or in the pipeline in every part of the NHS. Dr Tomlinson says “we had to cough up £40k to tender for a local practice that we were already successfully running – and at least that to tender for the Out of Hours contract.”

International comparisons

International comparisons are also helpful. A recent Commonwealth Fund reports suggest that the – til recently – less marketised UK system has been the most cost efficient in the developed world. A still more recent report found that Scotland now spends substantially less on hospital administration, than does England’s increasingly marketised system.

The Liberal Democrat conference this week heard a minority report from the NHS working group which suggested that scrapping the NHS market could save as much as 25% of the annual NHS budget. But their proposals to scrap the market were denied a vote by the party leadership.

The report noted that “countries where there is market competition in healthcare spend between 20% and 40% of their healthcare expenditure on administration”. It highlighted evidence from international experts that the increased use of markets in healthcare sharply increased administrative costs in New Zealand. Canada, Australia and Germany – soaring in the latter case by 63.3% between 1992 and 2003 and now standing at 20% of their health systems costs.

In the most marketised system of all, the USA, one healthcare dollar in every three is spent on adminstration of a system that delivers far poorer outcomes than the NHS. The Lib Dem report points out that healthcare billing alone cost up to 13%, noting “billing costs in healthcare providers are ten times the average of all businesses in the US. There is an inherent complexity to the business of delivering healthcare.”

These arguments are frequently dismissed by opponents. Former Editor of NHS managers bible the Health Services Journal, Richard Vize dismissed Labour’s tentative efforts to cost the market as “The old line that culling bureaucrats and lawyers is all that’s needed to fund new services…does not stand up to scrutiny.”

But where is that scrutiny?

The government told the Health Select Committee that the NHS still had “consistently low management and administration costs, ranging from 3-8%.[26]”. But MPs on the Select Committee found “considerable lack of clarity and consistency in … these data.”

Professor Webster (former NHS Chief Historian and Fellow of All Souls) says the “the managerial lobby” have mounted “a clever distraction…a defensive response…artfully disguis(ing) the scale of the increase by accounting procedures, such as concentrating on Managers and Senior Managers, to the exclusion of other relevant staff categories, reducing ‘administrative’ costs back to 5 or even 3 per cent.” But even this, he adds, cannot disguise that “the percentage of admin and clerical staff in the NHS has doubled (from 12%) since 1980”.

The government now boasts of ‘cutting red tape’, saying “There are now over 20,500 fewer managers, senior managers and admin staff, and nearly 14,500 more professionally qualified clinicians than there were in 2010.”

But as Dr Tomlinson says, any reduction in admin staff doesn’t mean a reduction in admin costs,necessarily, as now “medical professionals are doing a lot of the work such as choose and book, coding, and so on, that could be said to be market costs.”

OurNHS asked Kings Fund Chief Economist John Appleby if the recent influential Barker Commission on the future of health and social care funding had looked at the cost of the NHS market.

Appleby replied “no it didn’t. wld need to look at net change..might not be net ‘saving’ as you assume.”

“One problem is no study yet to test cost-effectiveness of market in NHS”, Appleby added.

His own Kings Fund 2011 study on the market ‘reforms’ to date merely said the cost was ‘expensive’ but ‘unknowable’.

Who is served by the lack of intellectual curiosity by these unaccountable ‘think tanks’ to whom the Department of Health has largely outsourced policy-making? Although their accounts are not very helpful, insiders tell me that the Kings Fund make a substantial proportion of their income from advising this sprawling bureaucracy how to deal with the permanent revolution of the marketplace.

Privatisation doesn’t work

If competition and markets improved health, perhaps the extra costs would be worth it.

We’ve had twenty years of being told the NHS should be run like a supermarket, most recently from M&S man Sir Stuart Rose.

And – as an inquiry convened by Debbie Abrahams MP found earlier this year, there’s scant evidence the market improves quality or health equity (and plenty of evidence it worsens both),whilst costing considerably more.

Just about the only academic study that claimed some ‘cost-effective’ benefits for NHS competition has been criticised for its “heroic” assumptions and failing to factor in the “whole system costs” of competition.

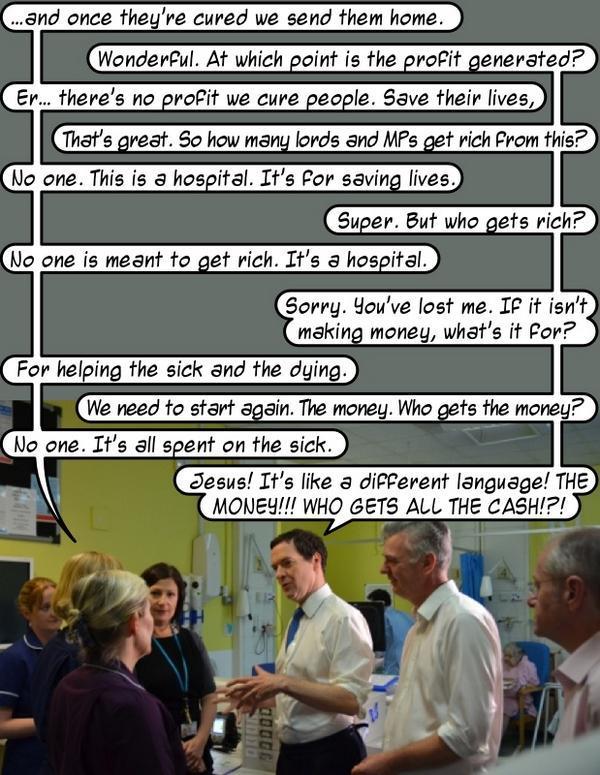

But then, we’ve known since the pioneering work of Nobel Laureate Kenneth Arrow in 1963 that markets in health care simply don’t work. Being a ‘customer’ of healthcare is not like being a customer of, say, oranges – it takes expertise that you and I simply don’t have, and the consequences of the wrong ‘choice’, or a provider closing down, are far more serious.

Bevan and Beveridge’s vision was for not for pseudo-‘choice’ but for local, skilled professionals making decisions on the basis of a ‘strong public sector ethos characterised by commitment and altruism’. They recognised only a publicly owned system could avoid ‘opportunistic behaviour by those who would seek to profit from illness’, with incentives to over-treat and over-investigate, stimulate patient demand through advertising.

Few health economists can agree whether NHS ‘productivity’ has improved, declined, or isn’t an appropriate measure. But evidence from the ground shows patient satisfaction and NHS staff morale are now declining rapidly.

For the cost of the market isn’t just financial. Patients are inconvenienced and even endangered as they are shunted between competing hospitals, GPs, community services and ambulances, all trying to dump costs on each other. The Francis report into the failures of care at Mid Staffordshire found that drive to market-friendly ‘Foundation Trust’ status had created a “supposed ethos of competition and commercial negotiation” which promoted secrecy and undermined co-operation between medical professionals.

Hinchingbrooke, the first NHS hospital to be fully handed over to the private sector – is still a financial basket case, despite having cut corners – and staffing – to the extent that everyone from the Royal College of Nursing to the Care Quality Commission are united in their condemnation of poor standards ofcare and demoralised staff.

Imagine what improvements to our healthcare could have been made, had NHS financial and leadership resources not been squandered on creating a market. As Paton comments, the ‘opportunity costs’ are huge.

So how do we rid ourselves of the creaking edifice of the NHS market?

The market system is now so entrenched it has been compared by demoralised staff to Stalinism.

But the Berlin Wall could yet crumble. Professor Allyson Pollock this week launched a ‘Campaign for an NHS Reinstatement Bill’ which provides a legal route map to sweep away most of the trappings of the NHS ‘market’ and restore it as a publicly owned, publicly provided service. They’ve already done it in Scotland, abolishing Trusts and most of the ‘market’ trappings following devolution. And – unlike England – Scottish patients now report rapidly rising satisfaction with their NHS.

The proposed Bill has already attracted support from Lord David Owen, Green MP Caroline Lucas and the Green Party leadership, Labour Parliamentary candidates, the National Health Action Party and the author of the recent minority Lib Dem report on the NHS, Charles West.

Getting rid of the market would be uncomfortable for the cadre of NHS managers, management consultants and think tanks whose main skill is permanent reorganisation. But it wouldn’t happen all at once. They’d have one last big job on their hands before retraining as something more useful to society, leaving a slimmed down management and a beefed up medical workforce to get on with the job of running an NHS in the interests of patients, not profits.

OurNHS needs funding to help keep us producing the NHS stories that matter – can you help?

About the author

Caroline Molloy is Editor of OurNHS and a freelance writer. In 2011/12 she was part of a successful campaign which reversed one of the largest planned NHS privatisations in the country, involving 9 Gloucestershire hospitals. Since then she has been campaigning alongside local and national groups to defend the NHS.

This article is published under a Creative Commons Attribution-NonCommercial 3.0 licence.